Crowdlending or P2P lending is a loan/debt-based crowdfunding

Our robust, highly customizable, and easy-to-use crowdlending software will streamline your work and empower you with a safer, faster, and more efficient crowdlending experience.

Even though the technology behind our fintech service is quite complex, our

Z-Cloud Crowdlending platform operates effortlessly to provide:

- The integrated Loan Management System (LMS)

- The integrated Investment Management Platform

- Possibility of combining Loans and Equity investments (Crowdinvesting)

- Interactive dashboards for investors and borrowers

- Integrated e-signature and online identification modules

- Customer due diligence & compliance (KYC/KYB/AML)

- Instant deposit payment options

- Automated Tax reporting

- Multilingual and multicurrency options

- Open API connectivity

- Very short time-to-market (TTM)

Among others, we have provided the technology behind one of Scandinavia's largest and most innovative Crowdlending companies – Kameo. A near decade of software development has resulted in a refined crowdlending platform with perfected security and cutting-edge technology, which has completed over 1500 loans with more than EUR 800 million in turnover!

If you want to offer a secure and user-friendly Crowdlending platform that seamlessly connects borrowers and lenders, ZWEBB Fintech can be your one-stop tech partner.

What is Crowdlending?

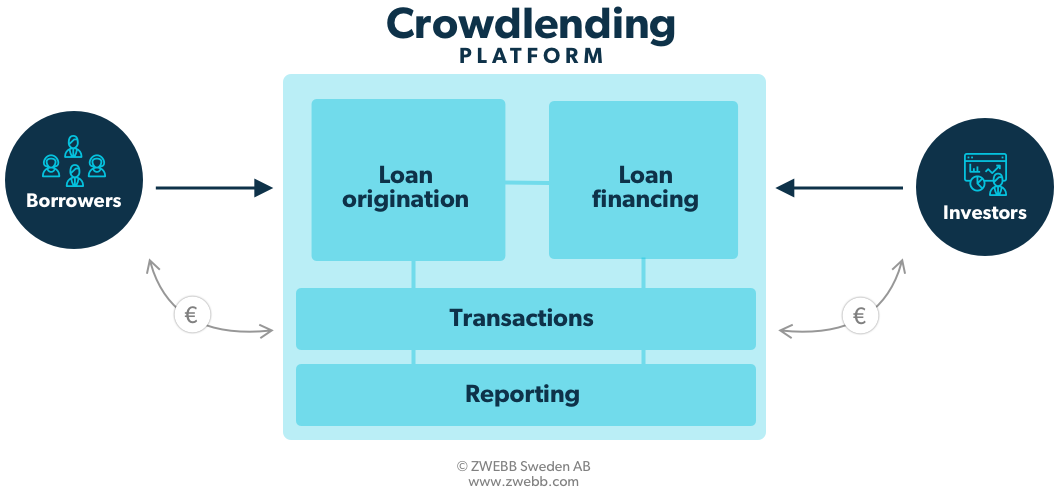

Crowdlending, loan or debt based crowdfunding, is a new way to provide business loans. In recent years, crowdlending has become a growing market and a brand-new, attractive field for investors. Since many banks reject loan applications from small businesses (SMEs), crowdlending or P2P lending has become an excellent financing alternative to traditional bank loans.

On the digital Crowdlending platform, suitable borrowers and lenders are seamlessly matched according to their credit risk rating and other specified metrics. This enables borrowers to obtain financing from multiple investors.

Becoming our partner is a win-win situation. You, as a platform operator, will provide financial access for those who are tired of traditional banking, and we will support you with the essential technology to fulfill your mission.

What is the Difference — Crowdfunding vs Crowdlending?

Crowdfunding is a growing phenomenon and a widely adopted concept in financing. Through digital platforms, individuals and corporates are able to make pure donations or earn future equity in borrowing firms. The latter is also called Crowdinvesting. This financing option carries high risk exposure, with funding either being in excess or insufficiently satisfied.

Crowdlending is a loan-based financing method where investors get regular returns on their invested capital. Crowdlending is often secured with collateral assets, shares, and/or personal guarantees. Investors usually reserve the right to have their investments back with interest. The returns can be withdrawn or reinvested into other projects on the crowdlending platform.

Crowdlending Platform Software Advantages

FinTech systems and financial solutions, such as crowdlending software, have high demands on technical performance. The calculations within crowdlending software are made complex by the necessary interactions between several high-tech features. At the same time, the platform must be user-friendly and load quickly, regardless of the device in use.

The unique software for Crowdlending (P2P lending) produced by ZWEBB Fintech is both a complex financial instrument and an easy-to-use tool, featuring solutions like direct and international investments, multilingual and multicurrency options, interactive dashboards, KYC/KYB/AML and RegTech compliance tools, all with integrated eID service for online identification and agreement sign-off.

With ZWEBB Fintech’s international experience, we have integrated a wide range of services to ensure that our crowdlending platform not only automates our clients’ workflows, but also complies with regional laws and regulations. This includes robust KYC/AML tools, banking and ERP integrations, virtual IBAN solutions, and more — all to ensure a secure, scalable, and future-ready platform for you, your lenders, and investors.

Our white label solution also includes the option of combining loans with equity crowdfunding (crowdinvesting), within our investment management platform, which is unique on the financial market!

Crowdlending is the future

Times have changed, and investing has gained traction beyond venture capitalists and companies, now to the ordinary individual. This simplicity has resulted in more activity for businesses in need of financing.

Crowdlending is the future, as it directly connects the right borrowers and lenders without unnecessary intermediaries. The technological advancement provided by ZWEBB's crowdlending platform takes the financial industry forward and opens up entirely new business possibilities.

Are you looking for a provider of a Crowdlending platform software adapted to your target market?

Please get in touch with ZWEBB Fintech by filling out the form below.